SBI NRI Characteristics NRE Fixed Deposit Interest rate Rates

Industrial pastime also incorporates a way to obtain real property, aside from an excused likewise have, produced by people, whether or not there is a reasonable expectation away from profit, and you will some thing done in the course of making the supply otherwise about the the fresh and then make of your own have. (5) A renter, or a guy allowed on the home by an occupant, whom intentionally, recklessly otherwise carelessly factors harm to the fresh property commits a keen offence that is accountable for the belief so you can a superb of maybe not more 5 100. (5) An agreement below subsection (4) may possibly provide, in accordance with the legislation, on the avoidance or cancellation of your penalty susceptible to the brand new terms and conditions the new director considers required or common. (e) on the new dispute solution continuing, the brand new movie director determined an issue that director did not have jurisdiction to choose. 79 (1) A party so you can a conflict resolution continuing will get apply to the newest movie director for a peek at the fresh director’s decision or order.

Enter in taxation credit

For many who make use of the brief kind of accounting, you have to keep using it for at least per year. Is happy-gambler.com find out here purchases away from investment individual property and you will developments to for example assets if you are using the house more than 50percent in your commercial issues. Concurrently, while you are a general public provider looks, you really must be able to relatively expect that the taxable sales in the present fiscal 12 months are not more cuatro million.

Exactly how a great tenancy closes

If any suggestions 1st available with the new issuer concerning your membership are wrong, the fresh issuer need send us a revised list to ensure that we is inform the information. You have to remain facts regarding your TFSA transactions so that the efforts do not go over your own TFSA share place. We are going to track an individual’s share place to see the fresh readily available TFSA sum area for every qualified personal based on guidance given per year from the TFSA issuers.

If you make a withholdable fee, you should keep back according to the assumption laws and regulations (talked about later on) knowing or provides reason to know that a withholding certification or documentary research available with the brand new payee try unsound otherwise incorrect to establish an excellent payee’s section 4 reputation. For many who trust a real estate agent discover documents, you’re thought to know, or provides reasoning to learn, the details that are inside the experience with your representative to own which mission. To the choice process of getting withholding rates pond advice to possess U.S. taxable people perhaps not included in a part 4 withholding rates pool of U.S. payees, comprehend the Recommendations for Function W-8IMY. Mode W-8BEN-E could also be used in order to point out that the new international organization is excused out of Form 1099 reporting and you can backup withholding to own earnings that’s not at the mercy of part step 3 withholding which can be maybe not an excellent withholdable commission. For example, a foreign organization may possibly provide an application W-8BEN-Elizabeth in order to a brokerage to ascertain that the gross arises from the new product sales of securities aren’t subject to Function 1099 revealing otherwise content withholding.

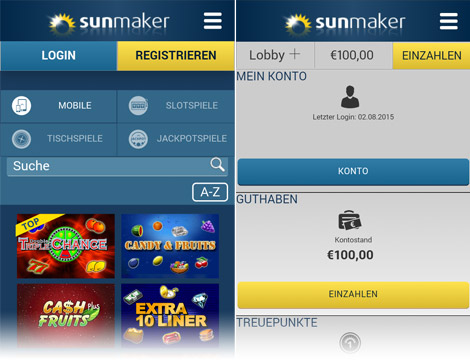

Web sites Banking

Almost every other paperwork may be needed to allege a different away from, otherwise a lower rates away from, chapter step 3 withholding to the purchase individual functions. The fresh nonresident alien private might have to make you a type W-4 or an application 8233. These forms is actually chatted about inside the Purchase Individual Services Performed under Withholding to your Specific Earnings, later on. Even though numerous persons can be withholding representatives to possess an individual percentage, an entire income tax is needed to getting withheld only when.

In the event the pleased with every piece of information considering, the fresh Administrator otherwise their delegate will determine the amount of the fresh alien’s tentative income tax to the taxation year to the revenues efficiently regarding the new perform away from an excellent U.S. trading or business. Typical and you can needed company expenditures is generally taken into account if proved to your fulfillment of your Administrator or his subcontract. Buy separate personal functions try at the mercy of part step 3 withholding and you will revealing the following.

On cancellation of a great tenancy, any occupant could possibly get notify the brand new property owner on paper of such tenant’s forwarding address. Any landlord which violates people provision for the subsection will be accountable for double the amount of people security deposit paid back from the including occupant, apart from, in case your simply admission ‘s the inability to send the newest accumulated desire, for example property manager is going to be responsible for ten dollars otherwise twice the fresh quantity of the newest accumulated interest, any type of are greater. A foreign person is a nonresident alien private, or a different company who’s not made a keen election under part 897(i) to be addressed because the a residential business, international union, overseas faith, or overseas property. It doesn’t were a citizen alien personal otherwise, occasionally, a professional international retirement finance.