How to Personal a fixed Put FD Membership on the or Prior to Maturity

Posts

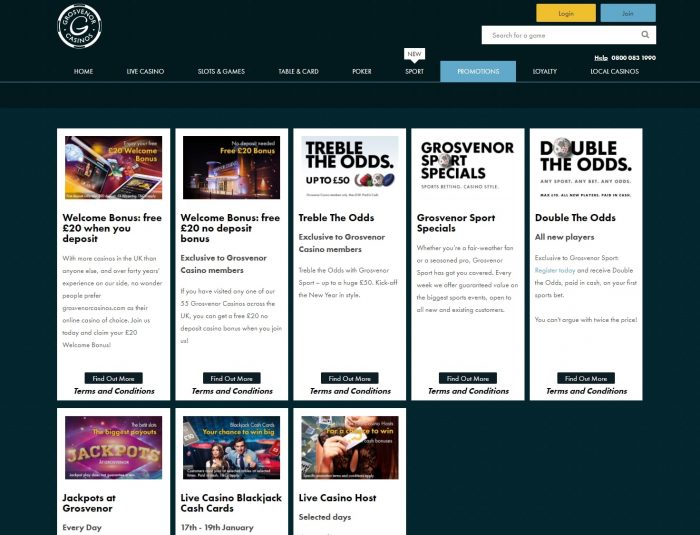

Name dumps works because of the agreeing so you can deposit a sum of money with a bank or some other Authorised Put-bringing Business (ADI) to have a fixed amount of time. You won’t manage to without difficulty availableness the bucks you’ve transferred during the phrase. It means you might’t without difficulty withdraw currency or “finest right up” the put that have a lot more deals. Sure, banking institutions and you will NBFCs generally impose a penalty to have prematurely closing an enthusiastic FD membership, plus the number may differ ranging from other creditors and you can models from places. Bajaj Finance now has an attractive rate of interest of up to 7.95% p.an excellent. We’re corporation believers on the Fantastic Code, that’s the reason article opinions are ours alone and now have not started in past times reviewed, acknowledged, otherwise recommended from the provided business owners.

Advantages of premature withdrawals

Utilizing the FD Early Withdrawal Penalty Calculator, you can assess the total amount might receive thus from detachment out of fund prior to readiness. Just before securing money on the a great Computer game, generate a reliable disaster money in the a top-yield checking account. This type of accounts render competitive APYs one to alter on the field. Nevertheless they render versatile access to your money instead of detachment punishment. When you’lso are ready to reallocate your bank account to own better output, Tap Purchase offers a variety of large-give money possibilities you to exceed repaired-rates choices.

I assessed another five key factors so you can choose an educated take into account your own personal fund requires. The publishers try dedicated to providing you with independent recommendations and you can guidance. I explore research-driven methodologies to evaluate borrowing products and you can companies, very are all measured equally. You can read more info on our very own editorial advice and also the financial methods on the ratings lower than. Designed for a straightforward, quick and you can customised banking experience.

What’s the means of withdrawing FD earlier develops?

Here’s all you have to learn about qualifying to own protected and you may unsecured handmade cards. Finder.com is actually a different research program and you will information service whose goal is to give you the tools you ought to make smarter choices. As we is separate, the fresh also offers that seem on this site come from organizations away from and this Finder gets settlement.

Following the identity, the fresh trader is also withdraw the main and desire. We during the Shriram Fund Limited feel the most reliable fixed put techniques for your protected and better upcoming. Call us any time to understand in more detail in the focus made to your FD restoration.

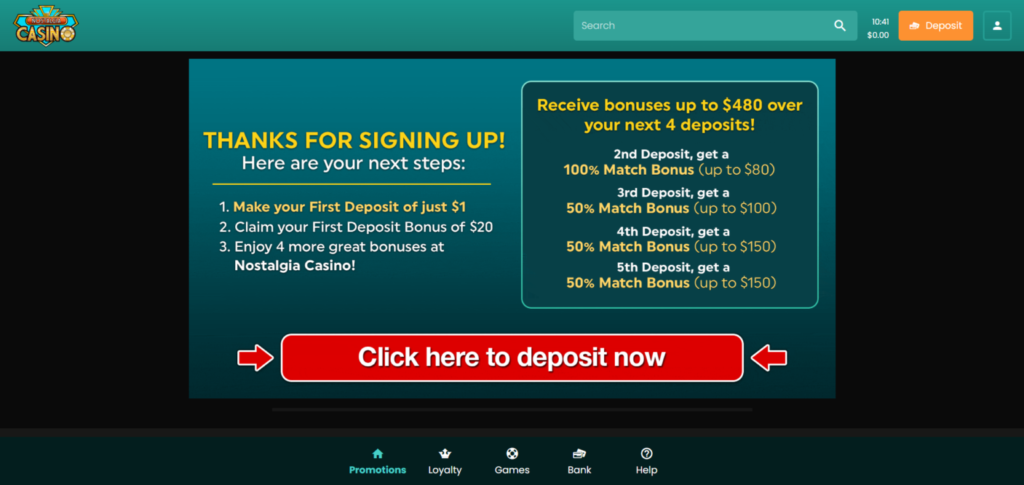

The possible lack of monthly costs and you https://realmoneygaming.ca/la-fiesta-casino/ may minimum 1st put will make it open to most savers. MoneyLion now offers one of the most straightforward bonuses on the financial community. You can generate a quick $5 for beginning a great RoarMoney family savings.

The newest account really does have a $1 fee every month, but because of the ease of generating the bonus, it does nevertheless be sensible. Views indicated within articles are just those of your writer. All the details of people tool try separately accumulated and you will was not given nor reviewed by company or issuer. The newest rates, terms and you can charges shown is accurate in the course of book, however these alter often. We recommend guaranteeing to the source to ensure by far the most upwards so far advice. As such, they supply versatile 2nd-options bank accounts to aid customers boost their banking history and ultimately progress in order to a far more satisfying membership.

Part of the online game is the just lay where you could score big bucks within the profits. Whenever deciding the earnings, shell out extremely attention to your own wager. The initial on the web slot machine Hurt you wallet will be demonstrated to any or all beginners and professionals regarding the world of playing.

How to withdraw a great SGD Fixed Deposit

Santander people aged 20 to 25 will get a free five-12 months railcard worth £100 – nevertheless they have to be quick while the bargain closes this evening. VAR checkout technology has absolutely nothing, nowt, zilch regarding “making it easier to own customers” and you will what you to do with Tesco cent grabbing during the expenses out of rules-abiding people. Heavens Development is unveiling a new totally free Money publication – providing you with personal finance tips like the you to definitely lower than. Rating expert advice, actionable actions, and you may personal now offers that help it can save you many invest which have trust. However, you have gotta make the efforts and you may adhere an incentives plan.

An important or joint account proprietor to the expected NetBanking history must access HDFC Financial’s NetBanking site with their customer ID and you may password. Very carefully opinion the related information about the newest FD, like the maturity day, desire gained, or other facts. Within the Repaired Deposit selection, click the Liquidate Fixed Put alternative.

For individuals who don’t you need credit cards instantly, there are many things you can do to change their credit before you apply to have a keen unsecured charge card. Your own charge card options could be somewhat restricted for individuals who’lso are still strengthening borrowing. The primary is actually expertise and that options perform best to suit your issues. Protected playing cards want a protection deposit, constantly comparable to the credit restrict. These types of notes are designed for applicants just who is generally strengthening borrowing.

Can you break a phrase put?

Find out the guidelines to possess on line protection to browse from the digital community which have strength and you will peace of mind. See 4 important ways to maximize taxation discounts and you may reach finally your fantasy homeownership. Within website, we speak about how EMI to the Credit cards lets you convert highest requests to your down money, providing independence and you will cost management. Change informal hunting to your perks to the RBL Bank Shoprite Borrowing Cards. In this web log, we’ll speak about “Digital Stop,” their risks, and you may standard tips to protect your on line protection.

Untimely withdrawal, also known as very early closure out of a keen FD, might lead to charges. Usually, HDFC reduces the rate of interest by step 1% regarding the rate appropriate to the months the fresh put occured. Just before proceeding, usually remark the fresh punishment guidance particular for the FD tenure. If you have a shared fixed deposit membership, you are interested in learning the newest closing procedure. Let’s consider the newest easy closure process that mutual account holders can also be pursue. If you have receive your self within the abrupt need of money, but your better nest-egg is closed away inside a term deposit, you happen to be capable break your identity put and you will availableness your discounts.

But quite often we crack her or him prematurely to meet the short-term exchangeability demands otherwise by taking profit an area you to definitely often allegedly give better productivity. On this page, I discuss as to the reasons it may not end up being a good idea to break the FD just before some time and how to proceed alternatively. The minimum lock-in the age of an RD membership are 3 otherwise half a year for some banks. If a premature withdrawal is carried out until then months, you do not secure any interest and just the primary deposited matter is actually refunded. Financial institutions will even subtract any incentive count that may have started provided when opening the new membership.